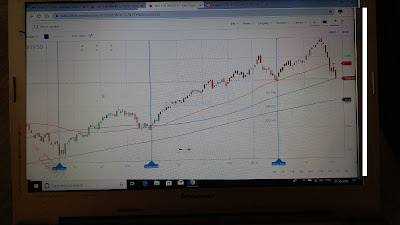

Tomorrow is a pressure date for market as per astronomy and election result. I expect a huge volatile day.

I expect good movements in below stocks. Please do not trade on these stocks based on my post.

1. Hindalco

Possible NR4 breakout. 200 MA and 50 MA @230 is a strong resistance.

Buy:223

Sell:215

2. ACC

Strong MA resistance 1460 to 1480

Sell 1420

3. Hindustan Unilver

Sell 1804

4. LT

10 MA resistance 1414,

Buy 1414

Sell 1372

5. Axis bank

Price action indicates a strong breakout possible

50 MA support 598

10 MA resistance 621

Buy

Sell 592

Buy 610.2

How to do we planning trading for Hinndalco intarday

Hindalco

Nature of trade : High probable trade

Trade duration : Intraday

Total capital 5 lakh

Total risk for 10th Dec : 1 % of 500000 i.e. 5000

Number of trades : 2

Risk per trade : 2500

Number of shares to be sold = 312

Margin required 4000

Total value 67000

Trade decisions :

If sell trade is favorable, will book 100 shares at 213 , 300 shares at 211 and 100 shares at 208 . Will do partial profit as sell position can not be carried over.

Estimated profit for sell = 2100

For buy trade , target will be 8 points. Will keep the buy trade for two days.

I expect good movements in below stocks. Please do not trade on these stocks based on my post.

1. Hindalco

Possible NR4 breakout. 200 MA and 50 MA @230 is a strong resistance.

Buy:223

Sell:215

2. ACC

Strong MA resistance 1460 to 1480

Sell 1420

3. Hindustan Unilver

Sell 1804

4. LT

10 MA resistance 1414,

Buy 1414

Sell 1372

5. Axis bank

Price action indicates a strong breakout possible

50 MA support 598

10 MA resistance 621

Buy

Sell 592

Buy 610.2

How to do we planning trading for Hinndalco intarday

Hindalco

Sell 215

SL 223

Target 208

SL 223

Target 208

Nature of trade : High probable trade

Trade duration : Intraday

Total capital 5 lakh

Total risk for 10th Dec : 1 % of 500000 i.e. 5000

Number of trades : 2

Risk per trade : 2500

Number of shares to be sold = 312

Margin required 4000

Total value 67000

Trade decisions :

If sell trade is favorable, will book 100 shares at 213 , 300 shares at 211 and 100 shares at 208 . Will do partial profit as sell position can not be carried over.

Estimated profit for sell = 2100

For buy trade , target will be 8 points. Will keep the buy trade for two days.