Today Nifty formed a bearish candle and heading towards 9950 support. Gann followers predicting low near 9826 on 29th October. This is 10 year cycle completion from last crash.

Please follow my trade journal to know why 29th October is so important.

Market reached to a bottom around 930 AM and I need to adjust my position to increase my profitability and reduce option long position to avoid weekend theta decay.

Click the link to know more on my monthly income plan using option trading

Update after 26th Oct market closure: Some legs covered today that resulted a profit of 4200.

My view about Nifty

Business cycle follow movement of moon north node. Moon north node is now in cancer. Based on past market behavior it indicates long term bear trend.

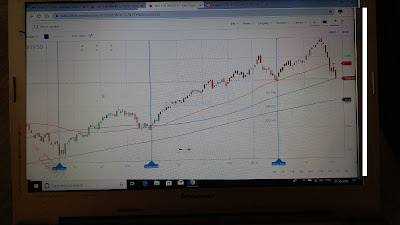

Nifty is already below its 200 MA

As an option trader, I follow weekly cycle and nifty just took support on 100 week moving average. Next support will be 200 week morning average.

Current positions

Long Nifty Dec 10000 PE 600

Long Nifty Dec 9000 PE 75

Short Nifty Nov 10200 CE 75

Short Nifty Nov 9500 PE 1275

Nifty Future long

Greeks

Delta 15

Theta 1868

Vega -1635

Gamma -0.35

Theta/Vega = 1.15

Negative Gama will be profit if Nifty's southward journey.

Estimated PnL on expiry day

With current volatility

9360 88000

9500 200000

10100 88000

Market view for 29th October : Market my witness gap up or gap down because day star is Rahu. Technically, emotion is very bearish.

RSI shows market is oversold so a pull back to Fibo level 10600 is possible.

Adjustments:

Please follow my trade journal to know why 29th October is so important.

Market reached to a bottom around 930 AM and I need to adjust my position to increase my profitability and reduce option long position to avoid weekend theta decay.

Click the link to know more on my monthly income plan using option trading

Update after 26th Oct market closure: Some legs covered today that resulted a profit of 4200.

My view about Nifty

Business cycle follow movement of moon north node. Moon north node is now in cancer. Based on past market behavior it indicates long term bear trend.

Nifty is already below its 200 MA

As an option trader, I follow weekly cycle and nifty just took support on 100 week moving average. Next support will be 200 week morning average.

Current positions

Long Nifty Dec 10000 PE 600

Long Nifty Dec 9000 PE 75

Short Nifty Nov 10200 CE 75

Short Nifty Nov 9500 PE 1275

Nifty Future long

Greeks

Delta 15

Theta 1868

Vega -1635

Gamma -0.35

Theta/Vega = 1.15

Negative Gama will be profit if Nifty's southward journey.

Estimated PnL on expiry day

With current volatility

9360 88000

9500 200000

10100 88000

Market view for 29th October : Market my witness gap up or gap down because day star is Rahu. Technically, emotion is very bearish.

RSI shows market is oversold so a pull back to Fibo level 10600 is possible.

Adjustments:

- If market is going up, will add Nifty long , square off 10200 CE

- If market is going down, square off 9800 PE and sell more call

My target is to earn 8000 from this position and 4000 already credited. I expect I will meet the target on Monday itself.

Nifty view for November

My friend Bramesh published a thoughtful analysis on Nifty based on astrological events.

Nifty view for November

My friend Bramesh published a thoughtful analysis on Nifty based on astrological events.

Very nice update...

ReplyDelete