How to trade Nifty based Gann price time square?

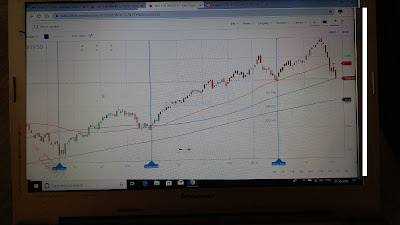

Nifty completed price time square on last Friday as predicted by Gann calculation and astronomical calculation.

Let us check what should be the next possible range of Nifty

117151 3rd Sept High

10030 26th Oct Low

Based on price range possible dates where market will show impulsive movements

| 28-10-2018 |

| 30-10-2018 |

| 05-11-2018 |

| 12-11-2018 |

| 20-11-2018 |

| 14-12-2018 |

| 18-12-2018 |

| 30-12-2018 |

| 15-01-2019 |

| 04-02-2019 |

| 25-02-2019 |

| 19-03-2019 |

Nifty did face resistance at 10200 on 30th October . Today, Nifty showed strength and reached to next critical resistance level 10400 and closed at 10386.

Next critical resistance 10609 and support 10201

Nifty made an intermediate high 10701 on 17th Oct . Considering 10701 as recent high, and 10030 as recent low, Nifty completed 50% pullback.

Nifty need to close above 10701 to resume its upwards journey otherwise Nifty might slip below 10000.

Nifty need to close above 10701 to resume its upwards journey otherwise Nifty might slip below 10000.

Let us check how astronomy can help us to predict possible Nifty movement

1st Nov , Thursday market might be range bound to up

2nd Nov, Friday might be a bearish day

5th Nov, Monday might be a volatile and bearish day

I consulted Financial almanac by Tamilsandhi

What option chain reveals ?

Put writing happened at 10400, 10300 and 10200. However, put unwinding happened at 10500. We can infer market participants expects stable to bullish market for 1st November

What are the possible Gann price levels?

26 th October close price 10030 squared at 90 degree offset of 53 degree calendar days.

Based on last price time square future possible price ranges are

10258 At this price previous downtrend will over as per Gann rule

10359

10460

10561

10663

On 1st November Nifty spot closed at 10380. Hence, Nifty resumed its northward journey.

Long trade can be initiated with first target 10460 and stop loss 10359.

My plan to trade nifty for Nov

sell 9600 put 10 lots

sell 11000 call 10 lots

Buy Nifty future and stop loss buy ATM Nifty put. Hedge the position overnight not in business hours.

What option chain reveals ?

Put writing happened at 10400, 10300 and 10200. However, put unwinding happened at 10500. We can infer market participants expects stable to bullish market for 1st November

What are the possible Gann price levels?

26 th October close price 10030 squared at 90 degree offset of 53 degree calendar days.

Based on last price time square future possible price ranges are

10258 At this price previous downtrend will over as per Gann rule

10359

10460

10561

10663

On 1st November Nifty spot closed at 10380. Hence, Nifty resumed its northward journey.

Long trade can be initiated with first target 10460 and stop loss 10359.

My plan to trade nifty for Nov

sell 9600 put 10 lots

sell 11000 call 10 lots

Buy Nifty future and stop loss buy ATM Nifty put. Hedge the position overnight not in business hours.

In future article, will discuss how astronomy can guide to improve the above forecast of future price and time.